– Nudge nudge, wink wink

– ‘Know what I mean..

Good morning. The Associated Society of Locomotive Engineers and Firemen has come up with a terrific way to celebrate the royal wedding on 29 April. It is calling London underground workers out on strike. This bold action by the downtrodden proletariat will throw into confusion the over-privileged aristocrats who had planned to travel comfortably by tube to a banquet of truffled ortolan and roast swan at the palace. Instead they will have to go by limousine. That’ll teach ’em. The ASLEF inaction will presumably disqualify its members from the deputy prime minister’s favoured group, the “backbone” of the country who rise early for work “rain, wind or shine”. They will be the government’s priority group for maximum support this year. Mr Clegg’s collective neologism for these people (known as hard-working families by the old government) is “alarm clock Britain”. His sentiment is clear enough but the appellation could come back to haunt him. What price “snooze button Britain” as the economy slows and unemployment rises, or “alarm bell Britain” when rising interest rates give house prices another knock.

It is not as if we do not already have “stopwatch Euroland”. It started ticking for Portugal yesterday when various EU luminaries, including the German chancellor, denied putting pressure on the country to accept a financial bailout. It is now a well-established tradition that the definitive start of any European Financial Stability Fund rescue is the denial of any need for it. Thereafter it is only a matter of weeks before the EFSF and IMF stuff money down the neck of the reluctant beneficiary and hand over a terrifying list of austerity instructions.

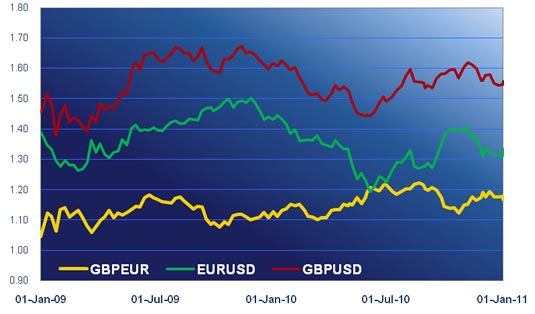

But there was zero negative reaction to the development. Indeed the euro strengthened by nearly a cent against the Swiss franc over the course of the day and collected around half a cent against the US dollar and the pound. The reason behind the euro’s unexpected success was an announcement by the Japanese finance minister that his country would buy a chunk of Euroland government bonds. “There is a plan for the euro zone to jointly issue a large amount of bonds late this month to raise funds to assist Ireland,” Noda San said at a news conference in Tokyo. “It’s appropriate for Japan to make a contribution as a leading nation to increase trust in the deal. We want to buy more than 20%.” With China already having expressed an appetite for Spanish government bonds investors found some reassurance that, even if they themselves would not touch Iberian debt with a bargepole then at least there were a couple of deep-pocketed sovereign wealth funds out there who would.

Whether this will improve Portugal’s situation is not yet clear. Yesterday’s denial suggests that Lisbon is already being cased by undercover EFSF and IMF agents in preparation for the bailout. The picture may crystallise tomorrow when Portugal attempts to sell €1.25 billion of three- and nine-year notes. If it can shift the whole lot at sensible rates it could win a stay of execution on the rescue. But it is not only Portugal trying to borrow money this week. Spain will be offering five-year notes on Thursday and Italy will be looking for 15-year money at the same time. There is ample scope for embarrassment unless China turns up to scoop the pool.

Beyond the Portugal bailout rumour-mill there was not much moving yesterday but there has been a drip feed of moderately interesting data from around the world. Swiss retail sales went up by 2.5% in November. Euroland investor confidence (Sentix) improved from 9.7 to 10.6. Canadian building permits were down by -11.2% in November after falling by -6.2% the previous month. New Zealand business confidence improved from 6 to 8 and building permits there were up by 8.58% in November. The British Retail Consortium reported a -0.3% fall in December retail sales, blaming it on “unusually early winter weather” and “concerns about the impact of spending cuts and the wider economy”. Australia’s trade surplus narrowed from $2.6 billion to $1.9 billion.

Today’s agenda looks even more threadbare, with nothing to cheer beyond Canadian housing starts and US wholesale sales. Japan’s trade figures and Nationwide’s index of UK consumer confidence come out at around midnight. And that’s the lot. Right. Who wants to buy a ticket for the Portugal bailout sweepstake? February 6 and February 13 have been snapped up already but there are still plenty of other likely dates available…