– Yields higher than for previous issues

– But who’s counting?

Good morning. Q: What’s the difference between an urban cannabis farm and a pair of guinea pigs? A: One attracts the full force of the law, the other is a cannabis farm. Having nothing better to do, Bradford’s finest were cruising the city in their helicopter when the thermal imaging equipment showed up an unusually warm garage. It could only be an illicit cannabis-growing operation. A raid on the premises revealed an electric heater and two guinea pigs, Simon and Kenny. The police made a tokin’ apology, admitting that some dope had made a hash of it and hoping the media would not make pun of them for raiding the wrong joint.

The euro’s critics were in a similar position yesterday, after their raid on Iberian government debt went awry. Hard on the heels of Portugal’s expensive but arguably successful sale of three and ten year paper on Wednesday, Spain ran its own auction of five year notes on Thursday. With €3 billion on offer the Spanish government received bids for more than twice that amount and managed to sell the notes for an average yield of 4.542%. Although Spain was forced to pay a percentage point more than it had at the last auction in November the market saw it as an acceptable result. Italy’s success in offloading €6 billion of bonds at the same time underlined the impression that peripheral Euroland government debt is not as unwanted as many had believed.

Killjoys at the International Monetary Fund did their best to rain on the euro’s parade. Deputy Managing Director Naoyuki Shinohara said Europe needs to “tackle structural issues” such as boosting growth. He also mentioned that Europe has not effectively addressed the continuing investor scepticism about Euroland debt. Taking the euro’s side was European Central Bank President Jean-Claude Trichet. At his press conference following the council meeting in Frankfurt he told journalists that the ECB’s actions to control inflation are “disconnected” from its efforts to support the euro zone banking system. In the context of a Euroland inflation rate that is now above its 2% target, investors inferred that the ECB would not see higher interest rates as incompatible with its purchases of Portuguese bonds.

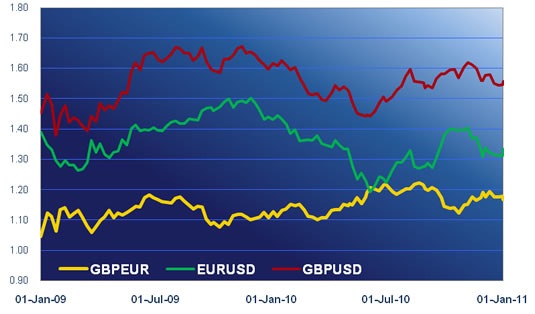

The message from the Bank of England was of no help to the pound. In words identical to those it has used since July the terse message from the Bank was that the Bank Rate would stay at 0.5% and the asset purchase programme would stick at £200 billion. The announcement was not itself damaging to sterling but nor was it enough to hold it in the half-cent range against the euro that it had enjoyed for the previous few days. Buoyed by the successful bond auctions and M Trichet’s apparently hawkish line on inflation the euro was again the day’s best performer. The pound took advantage of the euro’s advance, rising or holding steady against almost everything except the Swiss franc and the euro itself. The US dollar lost yet more ground. In the last week it has fallen by four and a half cents against the euro and the pound and has failed to make headway against the commodity currencies.

Thursday’s economic data did nothing to change sentiment. UK industrial production was on target with growth of 0.4% in November and 3.3% for the 12-month run. US producer prices were close to forecast, up by 4.0% in the year to December, and the States’ -$38.3 billion trade deficit in November was almost identical to the previous month’s figure.

Swiss and UK producer prices this morning are unlikely to shift the balance of power but investors will pay closer attention to the consumer price index data from Euroland and the United States. Euro zone inflation is expected to be unchanged at 2.2% while the American figure is forecast to rise from 1.1% to 1.3%. The day’s two most important ecostats will probably be US retail sales and the University of Michigan’s index of consumer sentiment (both provisional).

Normally one would expect the end of the week to provoke a round of profit-taking on the euro, especially after such a one-way trip. In today’s circumstances, though, the euro’s rally is itself a correction of last week’s weakness so there might not be much profit to take. Calling the euro higher still is not risk-free but that is the way it looks as London opens.