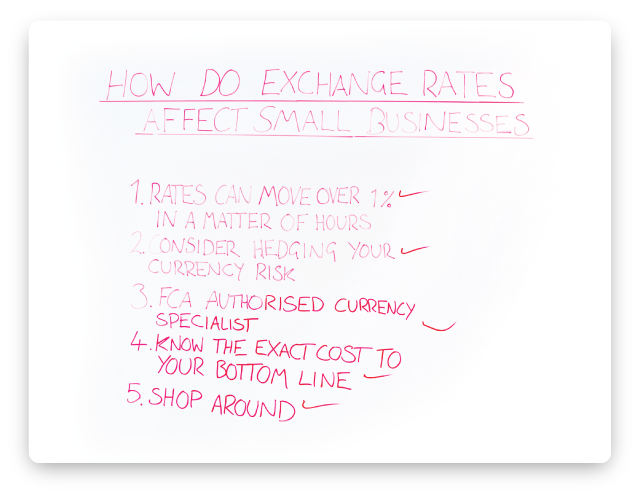

Unfortunately, exchange rates are sometimes a little hard to nail and get just right. Luckily, there are are a few rules you can follow to make sure that you are clued up on exchange rates and how they can affect your small business.

Good morning and welcome to today’s edition of MyCurrencyTransferTV. In today’s episode, we’re going to discuss how currency exchange affects businesses that trade internationally. It’s a very fitting week to cover this subject, as last week, we’re delighted to announce the launch of our sister product, CurrencyTransfer.com – built specifically for business international payments. The online marketplace matches businesses with multiple international payment quotes, with instant execution in one live transparent marketplace. Feel free to register for early access over at CurrencyTransfer.com

Let’s discuss how exchange rates can affect a small business that makes cross-border payments, and what you can do to score the best deal on your business foreign exchange.

Exchange rates can move over 1% in a matter of hours

Exchange rates can swing rapidly in a matter of hours, affecting the cost of business cross-border transfers. The FX market never sleeps, trading 24/7. This can make an enormous difference to the amount of money you could save or potentially lose out on. Volatility in the exchange rates are had to predict and mean businesses more than ever need to have a carefully devised currency strategy.

Consider hedging your currency risk

Non-bank foreign exchange specialists will be able to offer you currency contracts that can mitigate against the risk of adverse currency fluctuations. A forward contract, only requiring a 10% deposit, lets you fix today’s exchange rate for up to 12 months in advance. If you know you have to paying overseas suppliers at fixed dates in the future, forward contract can play a great role in building a currency strategy aimed at locking in favourable exchange rates. Likewise, consider a combination of limit orders and stop losses. Currency specialists are able to watch the market on your behalf and automatically fill a transaction when your target rate or worst-case scenario hits.

Typically, these currency contracts aren’t available within your normal online banking interface. As such, businesses can absolutely benefit from trading with a non-bank FCA authorised currency specialist.

FCA authorised currency specialists

Transacting with a high street bank can cost you up to £5000 on every £100,000 you transfer. Banks set their rates typically only once a day, and factor in a pretty wide spread to encompass market risk.

On the other hand, non-bank foreign exchange specialists call in to the live market, ensuring you get wholesale exchange rates that are pretty close to the real rate of the day. If you are a business trading sizeable amounts, aim to get quoted inside of 0.5% as a markup away from the mid-market exchange rate.

Know the exact cost to your bottom line

If you go to a supermarket, there’s an explicit price for a bar of chocolate, sweets or popcorn. You know what it costs your pocket the moment you look at the exact price listed on the shelf. Likewise, it’s important businesses know the exact bottom line cost on each and every cross border payment.

Sadly, foreign exchange is one of the last areas of financial services where most don’t know what they end up paying. Implied costs built into the exchange rate are not easily identifiable. As a top tip: calculate the difference between the ‘real’ rate, also known as the mid-market rate, and the exchange rate you are offered. Preferably, do this before booking an exchange rate with your supplier. Doing this simple but oh so important exercise, will let you identify the true cost to your bottom line.

Quite simply: The wider the difference, the worse the deal. The closer the difference, the better the deal.

Shop around

Try not to settle for the first deal you stumble across when booking an exchange rate with your non-bank foreign currency supplier. It pays to get at least two competitive quotes side by side, each time you transact. As mentioned in the intro, the launch of CurrencyTransfer.com lets you compare live rates from multiple foreign exchange providers, bidding to win your business. You can also book live trades within the venue.

We hope you enjoyed today’s episode of MyCurrencyTransfer TV. If you have any follow up questions, feel free to tweet them in. Our twitter handle is @mycurrencytrans or you can email me direct: [email protected]

See you next week!

Daniel Abrahams on Google+