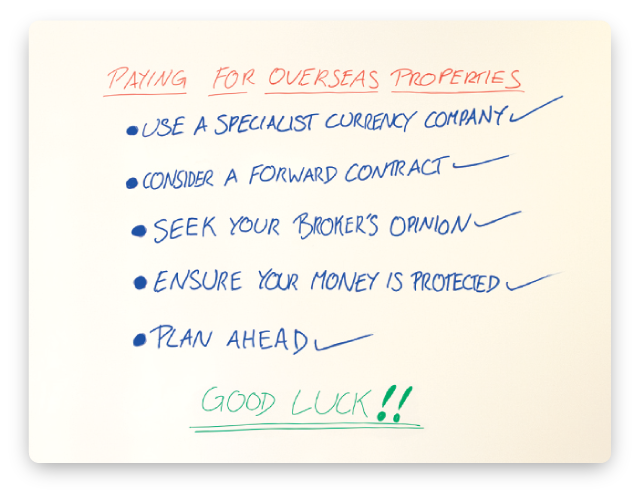

Finding the best way to to pay for your overseas property can be just as important as choosing which property to buy. Should I make a money transfer with my bank or a foreign exchange broker? How safe is it to use a currency broker for overseas property payments?

In today’s episode of MyCurrencyTransfer TV, Sofia guides you through the best way to make international money transfers when paying for your overseas property.

Find out how to maximise the value of your overseas property payments. We compare banks with brokers for international money transfers and consider the best way to save money on your international payments.

Video Transcription

Hi there and Welcome to another edition of MyCurrencyTransfer TV. Every week we have people come and ask us what the best ways of maximising money savings when paying for an overseas property. You will most likely be extremely excited about your property abroad but dread the boring aspect of paying for it. No one likes to think of the boring parts of a new adventure, but let’s face it, you will have to come to terms with the prospect at some point. And actually, it’s a good idea to plan in advance, because it will save you a substantial amount of money.

So how do you go about it? Well, there are several ways to maximise the value of your international money transfer and using a specialist foreign exchange company can help you do this.

Pay for an overseas property with a specialist currency company

Whether you are buying overseas property in France or Spain, your first instinct will typically be to take a trip to your bank, convert your money to the desired currency and let them transfer to your chosen destination. Big mistake. Banks are great for organising your assets within a country, but will charge you extortionate fees for transferring money internationally, without you even being aware. Seeking the advice of a specialist foreign exchange company will ensure that they offer you rates from as low as 0.5% mark-ups, which is a considerable saving from exchange rate markups of up to 5% from the banks. When interpreting these exchange rate markups in real money terms, this works out to a customer saving of around £3000 on every £100,000 you send abroad.

The benefits of a forward contract

Most people don’t keep an eye on the currency markets. However, when buying overseas property, this is good practise to ensure that the price of your property doesn’t escalate. Once you are familiar with the rates, you can book a forward contract with a currency broker that will lock the rate and effectively the price of the property so that you don’t have to be concerned with fluctuating rates. Rates can shift up to 10% within a day, which can see prices soar, so this is a handy currency contract when saving money on your property.

Seek your broker’s opinion

Your currency broker may not be a financial advisor, however they will be likely to have years of experience and knowledge of how the markets move and will be more than happy to share their knowledge with you. They might not be able to see in to the future and predict exchange rates but they will provide their judgement which will likely be more informed than yours. Do seek their expertise, they know best. After all it’s their job!

Ensure your money is protected

You wouldn’t leave your money lying around at home just in the same way that you wouldn’t entrust your money in any old person or company. You can be almost certain that your funds are in safe and good hands if the broker is registered under the Financial Conduct Authority (FCA) and HM Revenue and Customs. If you aren’t sure, check your broker’s website as this information will usually be listed on their homepage, if not, reconsider using them! All reputable currency companies make sure you money is segregated in a special bank account (segregated client accounts), so you can be sure your money is safe with them. Only consider currency companies with a minimum 5 year track record & seek referrals.

You can compare FCA Authorised & Regulated currency companies on MyCurrencyTransfer.com

Plan ahead

Paying for your property will most likely not be the end of the international money transfers you’ll need to make. You will probably have expenses such as bills, maintenance and administration that will become regular outgoings, so you will want a currency service close at hand. By establishing a good relationship with a currency broker from the beginning this will ensure that you feel comfortable going back to them time again. Most companies also offer a weekly market commentary newsletter and rate watch tools to keep you in the loop of exchange rates and the currency market.

Bonus Tip: Always try to have a relationship with a couple foreign exchange companies. This will ensure you get a couple of competitive quotes on every transaction you make.

We hope you have enjoyed this video and wish you the best of luck with your overseas property purchase!

Buying a property soon? Compare money transfers today!

Written by Sofia Kluge on Google+